Whether you run a global conglomerate or steer a mid-market specialist, the digital era has turned strategy into a contact sport. Cloud platforms spin up in minutes, AI copilots write code in seconds, and data flows at machine speed across borders. Yesterday’s five-year plan can become obsolete between quarterly board meetings. Against this backdrop, senior executives face a blunt question: how do we fuse corporate strategy and innovation so the company stays relevant, grows profitably, and earns the right to exist tomorrow?

We will explore how digital disruption reshapes the board agenda, what a modern corporate-level strategy looks like, and how to build an ambidextrous innovation engine without losing operational discipline. Expect no silver bullets – only hard-won lessons, current data, and actionable frameworks.

Why Digital Disruption Demands a New Board Agenda

Digital transformation is no longer an IT initiative. It is a macroeconomic force that is rewriting industry boundaries and capital flows. IDC forecasts worldwide digital transformation spending to reach $3.9 trillion by 2027, 16.1% CAGR over the forecast period, with double-digit growth in AI platforms and cybersecurity. These figures are not just large; they are strategic signals:

- Capital is shifting toward data-intensive, software-defined business models.

- Competitive cycles are compressing; leaders must iterate on strategy continuously.

- Talent, not technology, is the ultimate bottleneck.

Traditional playbooks like optimizing cash cows, protecting core moats, and dabbling in R&D fall short because disruptive attacks now come from adjacent industries or venture-backed ecosystems, not familiar rivals. Corporate boards, therefore, need a dual lens: protect downside risk today while placing bold bets on tomorrow’s growth arenas.

Rethinking Corporate Strategy for Continuous Reinvention

A modern corporate-level strategy has three intertwined mandates:

- Define an adaptable portfolio of businesses.

- Allocate capital dynamically toward future-ready bets.

- Orchestrate synergies, especially data, platforms, and talent, across units.

Too many organizations still separate “strategy” from “innovation,” thereby creating political silos and slow decision cycles. Best-in-class firms collapse that gap by treating corporate strategy and innovation as a single, integrated capability. They build governance structures that funnel market signals directly into portfolio moves and R&D roadmaps.

For a deeper dive on portfolio-shaping services and benchmarks, explore DXC Technology’s advisory insight here: https://dxc.com/advisory/corporate-strategy.

- Dynamic Portfolio Logic

Instead of categorizing units as “core” or “non-core” once a year, leaders now refresh the strategic intent of each segment every quarter. They ask:

- Does this business still derive advantage from the distinctive data, algorithms, or customer access we own?

- If not, can we pivot the model, partner, or divest before value erodes?

This cadence transforms the strategy office from an annual planning function into an operating system for reinvention.

- Capital Allocation at Digital Speed

Online investments – artificial intelligence models, cyber controls, and data streams – wear out quickly with changes in technology. Stage-gate capital models that venture funds embrace are therefore the ones progressive CFOs embrace. Granting is done on tranches based on leading indicators (user engagement, model accuracy, cost-to-serve), but not only lagging P&L. This will guarantee that limited cash will pursue new winners rather than the legacy projects that are fixed.

- Synergy Through Shared Platforms

In the analog world, synergy meant cross-selling or shared procurement. In the digital era, the biggest synergies arise from shared data platforms, common cloud architectures, and reusable AI services. Groups that articulate a “platform thesis” – e.g., one customer identity graph, one payment rail, one compliance fabric – unlock margin, speed, and innovation simultaneously.

Building an Ambidextrous Innovation Engine

Talking about innovation is easy; institutionalizing it alongside day-to-day efficiency is hard. An ambidextrous engine balances two streams:

- Explore – incubate disruptive opportunities (e.g., generative AI-enabled products).

- Exploit – continuously improve existing offerings.

From Incremental Wins to Generative AI Leaps

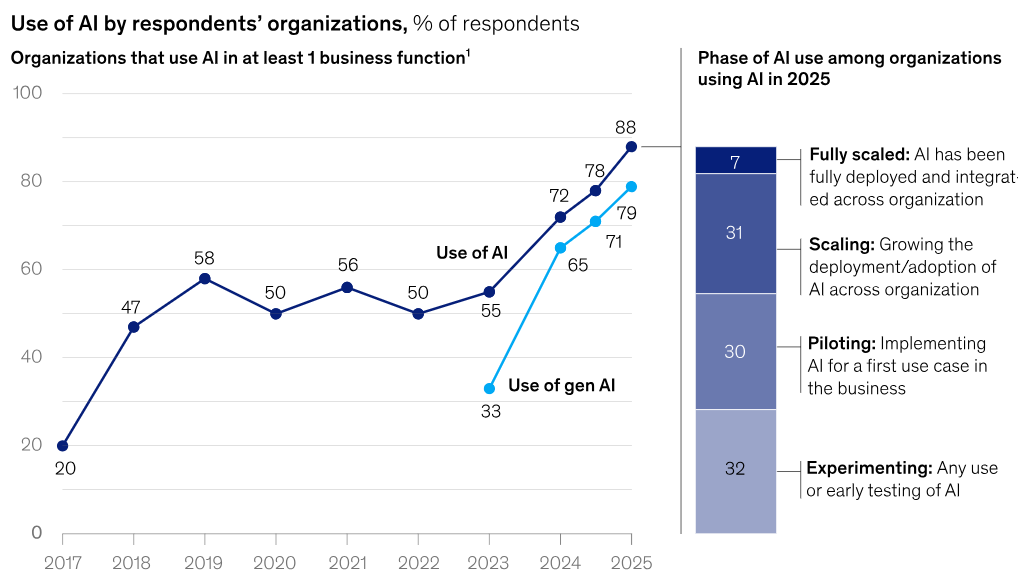

Over 88% of enterprises experimented with generative AI pilots in 2024-2025, but only a fraction scaled them.

Winners applied three design rules:

- Value Chain Targeting. Map where cognition (text, code, design) drives cost or revenue, then insert AI agents precisely there.

- Guardrails First. Establish model governance, security, and responsible-AI principles before launch.

- Reuse-Before-Build. Leverage open-source or partner models where commodity suffices; build proprietary models only where differentiation is clear.

By embedding these rules into the innovation funnel, firms ensure that the exuberance of exploration feeds the discipline of exploitation, keeping both regulators and investors on side.

Culture: Turning Middle Managers into Innovators

Even with perfect processes, innovation stalls if the cultural antibodies of middle management reject new ideas. Progressive companies, therefore:

- Rotate high-potential managers through venture studios or digital labs.

- Tie 20-30% of variable pay to innovation Key Performance Indicators (experiment velocity, time-to-pivot, and adoption rates).

- Publicly celebrate “fast, inexpensive failures” as learning wins.

When managers see innovation as career fuel rather than career risk, the engine accelerates.

Orchestrating Ecosystems and Platforms

No firm can master every capability in-house. The digital era rewards those who curate ecosystems of startups, academia, big-tech hyperscalers, and even competitors. The task of the corporate strategy and innovation teams is that of platform orchestrators, and their decisions on whether to build, purchase, partner, or invest are made.

- Open APIs as Growth Levers. In revealing product capabilities through secure APIs, businesses are asking third parties to develop complementary services, which increases network effects.

- Equity Investments with Strategic Options. The early-access roadmaps and impact on standards can be obtained by having a minority stake in a critical AI vendor.

- Data-Sharing Coalitions. Data pools of the cross-industry are beneficial in that they enhance predictive accuracy of fraud, supply-chain risk, or health outcomes, benefiting all members.

The strategic litmus test is clear: if an external partner can achieve the capability faster and cheaper, partner first. Reserve scarce internal talent for a proprietary edge.

Governance, Talent, and Culture at the Corporate Level

A sophisticated corporate-level strategy also rewires governance. To combat AI ethics, cyber resilience and digital capital allocation, boards now hold Technology and Innovation Committees. There is one story as minutes of those committees serve directly into the discussions of the main boards.

Measuring What Matters

Conventional KPIs such as ROI, EPS, and cost of goods do not go away; however, they fall behind. Forward-looking measures are added by leading boards and include:

- Digital Revenue Mix – percentage of sales from digitally enabled products.

- Algorithmic Advantage Index – share of decisions automated by proprietary AI.

- Talent Velocity – time to upskill or redeploy employees into new digital roles.

Regular monitoring of these indicators every quarter will enable the correction of the course before the annual report will shock investors.

Talent Market Dynamics

OECD research highlights that lack of relevant skills is a major barrier to AI adoption, with many employers reporting difficulty hiring or training workers with the needed capabilities. Forward-thinking firms counteract shortages by:

- Skill-Adjacency Hiring – hiring statisticians and physicists and training them to do ML ops.

- Internal Marketplaces – The gig-type platform that employs micro-projects where workers bid and disseminate knowledge at a rapid pace.

- Outcome-Based Learning – the completion of the course is not connected to certificates but to actual deliverables of the project.

Embedding these talent flows into corporate strategy and innovation planning ensures the portfolio is human-ready, not just tech-ready.

Putting It All Together: A 90-Day Action Blueprint

A strategic reset loses power if it drifts into a twelve-month slide-deck marathon, so many boards now authorize a ninety-day sprint that blends urgency with real governance. What follows is less a rigid recipe and more a choreography that keeps momentum high while proof points accumulate.

Week 1-2 – Portfolio Heat-Map

The process starts with an unfiltered conversation among business-unit heads, usually off-site to escape home-turf politics. Each leader arrives with a single slide explaining where digital could double impact and where competitors might already be eroding the moat. By debating these positions in the same room, without intermediaries, the team surfaces overlaps, blind spots, and immediate synergies. Strategy officers translate that raw dialogue into a heat map that ranks every unit by disruption risk and opportunity upside, creating a north star for the sprint.

Week 3-6 – Innovation Pipeline Audit

Armed with the heat map, a small tiger team fans out to inspect every ongoing digital project. The aim is not to assign blame but to understand which bets have a crisp value hypothesis and which survive on corporate folklore. Projects lacking customer traction or clear technical feasibility are paused, freeing scarce talent and budget. Survivors receive sharpened milestones that can be verified within a calendar month, reinforcing the message that velocity and discipline are twins, not rivals.

Week 7-10 – Capital and Talent Reallocation

At the midpoint, the CFO releases seed funding in modest tranches tied to those newly defined milestones, while the CHRO green-lights secondments for high-trajectory employees. These individuals spend up to forty percent of their week inside cross-functional “micro-start-ups,” yet remain anchored in their home units so that fresh knowledge flows back rather than vanishing into a lab. This dual citizenship keeps core operations stable even as experimental ideas gather steam.

Week 11-13 – Ecosystem Activation

Momentum now shifts outward. Business development teams sign data-sharing or co-development deals with third-party partners that were found during the audit stage. Drafting a legal document introduces boilerplate that maintains rapidity, yet complies with various rules and regulations, and cybersecurity checks the integration plans dynamically so that the handshake and the hazard scan are not joined by a delay of several years.

The initial external demonstration of concept – typically an API mash-up or sandbox experience – is put into production by the end of week fourteen, letting both staff and shareholders understand that the organization has a lens of innovation that goes past its four walls.

Week 13-15 (Rolling) – Board-Level Integration and Cultural Hardening

The sprint culminates in a working session with the board’s technology committee. Project leads, not senior executives, present outcomes, challenges, and next-quarter asks. This role reversal forces candid storytelling and lets directors probe the granular assumptions behind each bet. Out of that exchange come two deliverables: an updated rolling forecast that marries milestone-based funding with traditional P&L views, and a culture charter that codifies how future sprints will blend experimentation with fiduciary duty.

Conclusion

Digital disruption is relentless, but it is also predictable in its underlying mechanics: data liquidity, AI-powered insight, and network effects. Companies that weave corporate strategy and innovation into one muscle – supported by adaptive governance, dynamic capital allocation, and ecosystem orchestration – are positioned to thrive. Those that cling to yesterday’s siloed playbooks risk rapid irrelevance.

As you exit this article and face your next leadership meeting, remember the most important mandate: strategy is no longer an annual memo; it is a living operating system. Equip it with the right talent, metrics, and cultural DNA, and your organization will not merely survive the digital era – it will define it.